Retirement is a period of life during which one enjoys the fruits of one's years of labor. It's an opportunity to enjoy a permanent vacation, soaking in the sun, and relishing summer days at leisure. The key to retiring like being on a constant vacation lies in meticulous and strategic planning. Here's how to do it.

Read more

Planning for retirement can be overwhelming, but it becomes much easier if you start early. If you plan to retire in 2025, there are specific financial tips that you need to implement now to work toward an independent retirement. Here are some essential areas you should consider.

Read more

Achieving financial freedom is a goal that many of us desire, but some might believe is too far away to reach. It's a daunting task, especially when bills pile up, cost of living increases, and we bury ourselves in debt.

Read more

Filing your taxes can be simple when you're prepared and understand recent changes in tax laws to determine which tax credits and deductions you're eligible to take.

Read more

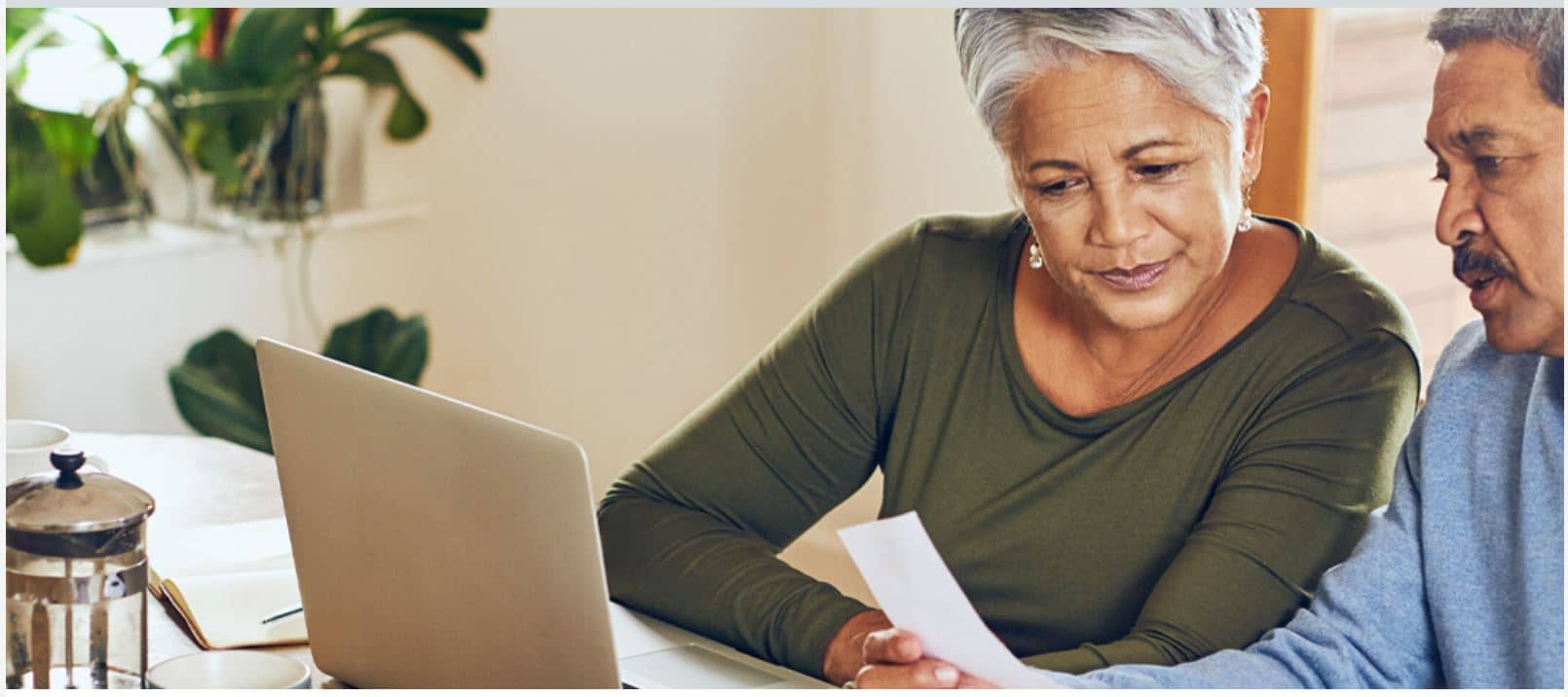

Navigating your retirement savings can be a challenging process due to the inherent complexities and the multitude of factors that tend to affect the most confident plan.

Read more

Establishing financial wellness is a personal, ever-changing state of being that enables one to exercise choice while feeling in control of finances.

Read more

The average household with credit card debt had a balance of $7,149 in 2020. For the average household carrying credit card debt as of September 2020, this equates to an annual interest of $1,155.

Read more

The average household with credit card debt had a balance of $7,149 in 2020. For the average household carrying credit card debt as of September 2020, this equates to an annual interest of $1,155.

Read more

Will you pay higher taxes in retirement? It’s possible. But that will largely depend on how you generate income. Will it be from working? Will it be from retirement plans?

Read more

2021 is a great time to focus on your retirement savings! Thanks to the power of compound interest, the more you save this upcoming year, the better off you will be later.

Read more

If you are not contributing to your health savings account (HSA), you miss out on a great way to save for health care expenses now and during retirement . HSAs allow you to save money tax-free through payroll deduction.

Read more

If you're self-employed or own a small business, you've probably considered establishing a retirement plan.

Read more

As 2020 comes to an end, more and more Americans are contemplating their decision to retire. Others are tapping their retirement savings, while some save more due to the economic fallout and impacts of COVID-19.

Read more

End Of Year $ Moves It’s that time of year again; close to the end! As we enter the last quarter of the year, remember these money moves that you still have time to make: Add to Your 401K.

Read more

The CARES Act (The Coronavirus Aid, Relief, and Economic Security Act) became law on March 27 th , 2020, and contains significant legislation for Required Minimum Distributions (RMD) for those over age 70 ½ who have already started RMD.

Read more

If you have multiple or only a few retirement ‘nest eggs,’ now is an excellent time for us to discuss how taxes will impact you this year or in the future.

Read more

In November 2019, the Internal Revenue Service (IRS) announced the cost of living adjustments for 2020 for most retirement savings plans. However, IRA contribution limits will stay the same.

Read more

What is underway as one of the most significant changes to retirement savings plans in years, the SECURE Act (Setting Every Community Up for Retirement Enhancement Act of 2019) was passed in May 2019 by the U.S. House of Representatives.

Read more

Losing a spouse, whether through death or divorce, can be devastating emotionally and financially. The loss can take months or even years to recover since there is no way to prepare for death or divorce even when spouses have discussed contingencies with each

Read more

The ‘Boomer Generation,’ those born between 1946 and 1964, have a great outlook for a long life since they will outlive previous generations by almost 40%, compared to their great-grandparent’s generation.

Read more